Your Tax Day Checklist: How to Prepare to Avoid an Audit

Despite everyone’s awareness that tax day is rolling around each year, many companies still end up leaving their filings until the last minute. As a result, the last-minute filings can easily lead to accidental mistakes when filing.

Nobody wants to intentionally make mistakes, but especially when it deals with your taxes. Why? Because mistakes on your tax return are often a red flag for IRS to investigate further.

So how can you properly prepare to minimize your likelihood of an IRS audit? Well, the following tips are a good place to start.

1. Download the IRS calendar

There are often more deadlines beyond April 15th. Ensuring your company is aware of any and all deadlines is imperative to ensure you don’t miss important deadlines. For example, depending on your organization type, you may be responsible for submitting quarterly returns rather than just annual. Downloading the IRS tax calendar will send you electronic reminders to ensure that you don’t miss any important due dates.

2. Understand the potential impact of legislation

The importance of understanding the impact relevant legislation may have on your business is even more critical given the variety of COVID-related legislation that has affected businesses nationwide. Understanding the impact that the CARES Act and other legislation may have on your business’s tax filings may play a role in ensuring that you don’t over or underpay on your taxes due nor incorrectly declare your personal income.

Partnering with a CPA or tax attorney can help ensure that your bases are covered and you’re properly prepared to lessen your chance of a potential audit.

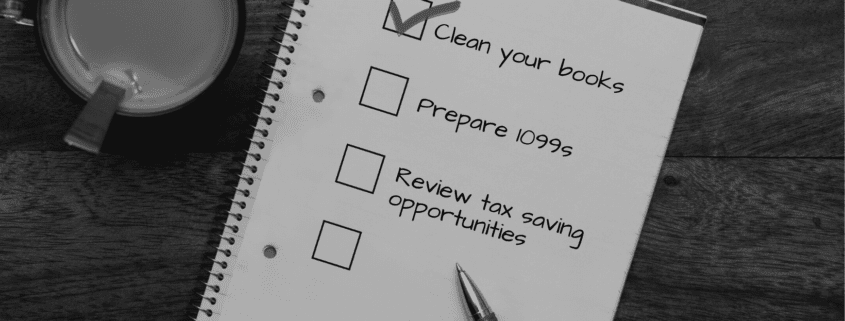

3. Clean your books

Do your CPA and tax attorney a favor and don’t wait until April to get your finances cleaned up. Maintaining clean and organized financial documentation should be something that your company strives for year-round, not just when the clock is ticking to get your returns submitted to IRS.

4. Document all expenses

In many cases, businesses may be eligible to deduct qualifying expenses from their returns. That being said, this can only be done if there is proper documentation to prove the qualification of such expenses. The best practice is to document everything.

5. Prepare your 1099s

Ensuring proper documentation and classification of your company’s workers is critical if you want to avoid a potential audit. While IRS audits are what comes to mind initially when considering the threat of a tax audit, EDD is actively partnering to audit businesses as well.

Should it come to light that your business incorrectly classified a worker as an independent contractor that should have rightfully been a full-time employee, EDD may decide to audit your business to claim the employee taxes that you owe.

Once EDD has audited you and has proven that you incorrectly classified your workers, they very well may likely pass you over to IRS to dig deeper into your finances and potentially audit you for criminal liability as well. IRS can then investigate tax fraud for missing payroll taxes owed on W-2 workers but not paid for 1099s and a criminal investigation into insurance fraud for unpaid workers compensation can also be triggered.

Correct classification of your workers can be a make or break in protecting yourself against both EDD and IRS audits. If you’re not sure about the correct classification of your workers, reach out to our team of legal experts at Milikowsky Tax Law for support.

6. Have liquid capital ready to make a payment

While it’s not required to pay your annual tax responsibilities in full right away, your business shouldn’t overcommit its savings to a point that you’re scrambling to afford to make your tax payments. Opting into quarterly payments is an option in this regard, however, shouldn’t be taken lightly as pushing off payments down the line can quickly turn into a slippery slope.

7. Review tax saving opportunities

In addition to classic tax write-offs that may be available to you, it may benefit you to review additional tax-saving opportunities for your business. Some of these may include the following:

- Cost segregation

- Bonus depreciation

- R&D tax credits

Working with a CPA or other tax professional may help you identify ways to save money while not making yourself a target for a potential tax audit.

For more helpful tips on conquering this tax season, reach out to our legal tax experts at Milikowsky Tax Law. While your CPA is an excellent partner for preparing and submitting your tax returns, they may require the support of a legal professional in the event of an IRS notice or audit.