WELCOME TO THE MILIKOWSKY TAX LAW BLOG

Providing actionable insights and valuable information to help you navigate the complexity of tax law for your business.

IRS & EDD Audits

If you recently received a letter from IRS, there are few important steps you need to take to protect yourself. While IRS will occasionally audit businesses randomly, they usually audit an individual or business because your tax return contains an error or a transaction that is inconsistent with other businesses in your industry.

PPP Fraud: IRS Vows to Crackdown

2020 was a challenging year for many business owners. The ongoing global pandemic not only brought on a health crisis, but an economic crisis to match. While many companies were able to stay open because they were deemed to be essential workers,…

EDD Audits: A Cautionary Tale

No one wants to find themselves under audit. Whether from IRS, EDD CFTB, or other government agencies, audits are stressful and time-consuming. When it comes to facing an audit, how you react at the start of the audit can make all the difference. …

Form 5472 Foreign Owned Company Filings

One important aspect of being a business owner is ensuring that you keep up with changing laws and regulations that may be applicable to your business. There are consistent changes and updates being made to various legal requirements and ignoring…

Why IRS is Planning to Audit More Small Businesses This Year

Late in 2020 IRS announced that they intended to increase audits of small businesses by 50%. This news came as a shock to many small business owners who were still attempting to recover from the economic downturn brought on by the COVID-19 pandemic.…

Insights for CPAs to Minimize Audit Risk for Their Clients

If you are a CPA, here are 4 things to help your client reduce the risk of an EDD, IRS, or SBA audit:

1. Confirm that your client’s 1099-K (provided by a merchant processor) does not report gross proceeds from credit card sales that are higher…

How Taking Advantage of the Tax Deadline Extension May Benefit You

As a result of the ongoing global pandemic, IRS has elected to extend the 2020 tax submission deadline to May 17, 2021. Following last year’s deadline extension to July 15, it was predicted early on that this would likely be the case.

As…

What To Do if Your Tax Return Is Flagged by IRS

Tax season brings on additional stress for many. First, the hurry to get your information prepared and submitted for review by IRS. Then follows the thoughts of whether or not your information was submitted correctly or whether you’ll be faced…

How to Minimize the Risk of an EDD Audit?

Need to review 1099 classification criteria? CLICK HERE:

How do you minimize the risk of an EDD Audit?

There is no way to eliminate the risk of a government agency audit, audits are performed on a number of criteria, from a site sweep…

How Proposition 22 Continues to Influence the Gig Economy

After companies including Uber, Lyft, DoorDash, and others spent nearly $200 million campaigning for the addition of a ballot measure exempting them from the previously passed California AB5 ruling. They won, and so began Proposition 22.

The…

Corporate Tax

Determining the amount of taxes you owe depends on the type of business entity your corporation is. To avoid double taxation, or when both shareholders and the corporation pays taxes, the business chooses which kind of corporation it is and who will pay the taxes.

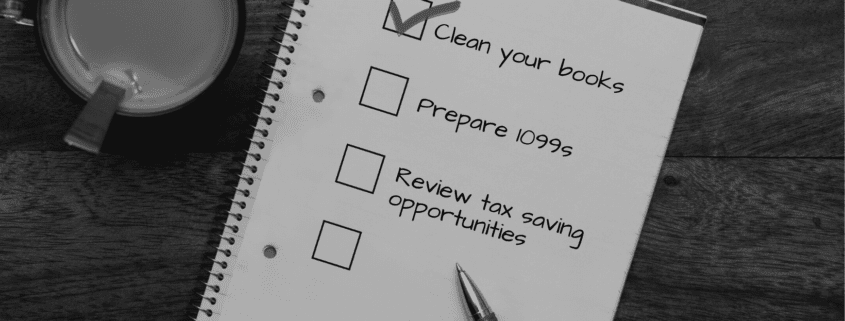

Your Tax Day Checklist: How to Prepare to Avoid an Audit

Despite everyone’s awareness that tax day is rolling around each year, many companies still end up leaving their filings until the last minute. As a result, the last-minute filings can easily lead to accidental mistakes when filing.

Nobody…