WELCOME TO THE MILIKOWSKY TAX LAW BLOG

Providing actionable insights and valuable information to help you navigate the complexity of tax law for your business.

Entity Formation and Business Planning

The decision about what business entity to select for a new venture has critical implications for liability and tax consequences. This can affect the stakeholders of the entity as well. There are different rules and regulations that apply…

How Could My PPP Loan Have Exposed My Company to Criminal Liability?

How could my PPP loan have exposed my company to criminal liability?

Now that your small business has a PPP Loan, it is time to consider how this may have exposed your company to criminal liability. Since the US government does not give out…

How To Resolve an IRS Tax Balance

Owing Back Taxes: How to resolve an IRS tax balance:

Does your business owe taxes to IRS – payroll taxes, income taxes?

Did IRS file a federal tax lien against your business that is preventing you from getting a loan?

Founder, John Milikowsky…

Chamber of Commerce Tax Credits and Changes

What Tax Credits and Changes Could Affect Your Businesses 2020 Tax Filing?

The U.S government works to pass legislation to help reduce the damage caused by the shut down of our global economy in the face of this novel coronavirus. The CARES…

Small Businesses Set to Receive Funding from the Main Street Loan Program!

Coronavirus has caused companies of all sizes to take a hit. To help your businesses that need extra funds, the federal government came out with a few funding options. The Main Street Loan Program was intended to serve larger businesses like…

Paula Brunoro Discusses International Tax Challenges & Techniques For Corporations

SAN DIEGO, CALIFORNIA, UNITED STATES, June 18, 2019 /EINPresswire.com/ — Leading international tax attorney, Paula Brunoro-Borokhov, of Brunoro Law, APC., conducted a live international tax challenges webinar for tax…

Were Your Finances in Line When You Applied for SBA Loans?

Organization is Key: Were Your Finances in Line Before You Applied for Your SBA PPP Loan?

The SBA relaxes the loan forgiveness criteria in mid June allowing you 24 weeks to use SBA funds and to allocate 60% of funds to payroll. This is replacing…

Will SBA Relief Funds Meant for Small Businesses Be Returned?

Small businesses continue to struggle to acquire SBA PPP funds, as a few larger companies refuse to return the funds they have received. Though these larger publicly traded companies could face severe consequences, the threat is not causing…

Will SBA Audits Result in Criminal Exposure for Business Owners?

In April 2020, the Paycheck Protection Program (PPP) was announced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The PPP granted loans to businesses across the country to support more than 51 million jobs and…

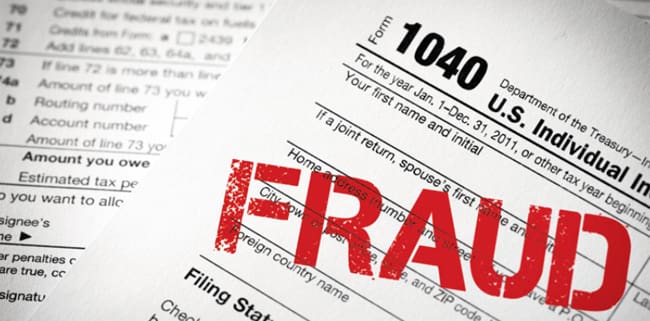

Signs the IRS is Looking for to Prove Criminal Content

The potential penalties that arise when borrowers apply for the SBA PPP loan has business owners questioning whether or not they should keep their loan funds. Borrowers must consider their individual circumstances to make this decision, but…

Steps to Reduce Being Considered for Fraud in an Audit

The SBA PPP loan is to help support small businesses that would otherwise disappeared due to COVID-19. Now that these funds have been widely disbursed, the federal government is stepping it. They are taking action to check on the recipients.…

One Major Red Flag To Watch Out for if You Take Cash Out of Your IRA Under the CARES Act

Heads up — while you are now allowed to take up to $100,000 out of your IRA and pay it back within three years with no tax hit, doing so may have some hidden consequences that you likely have overlooked initially.

The Internal Revenue Code…