WELCOME TO THE MILIKOWSKY TAX LAW BLOG

Providing actionable insights and valuable information to help you navigate the complexity of tax law for your business.

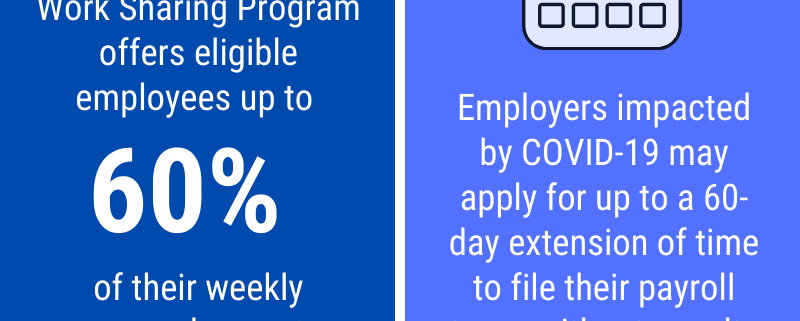

COVID-19 Business Owner Resources

As business owners, and former business owners, we at Milikowsky Tax Law know how challenging these times can be. Here are resources specifically focused on the Small to Mid-Sized Business Owner (under 500 employees). If you find yourself…

IRS Is Limiting Certain Enforcement Actions

In a surprising turn of events, IRS is limiting certain enforcement actions. To read the entire article visit IRS.gov

"The new IRS People First Initiative provides immediate relief to help people facing uncertainty over taxes," Rettig added…

International Tax Audits

The area of international taxation is incredibly complex. It requires a detailed understanding of the laws of the countries involved in the transactions, as well as how various treaties impact the tax consequences of business operations. At…

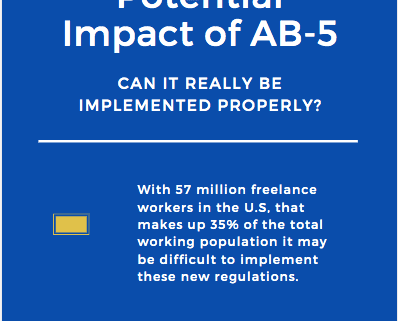

Will AB-5 Withstand Coronavirus?

As we look forward from April into the second quarter of 2020 the question on many business owner's minds is: will the rules outlined in AB-5 stand in the face of coronavirus? At the start of 2020, business owners' level of concern about California…

The Coronavirus Impact on Tax Law

The full scope of the coronavirus impact on tax law (and all other areas of business in the US and around the globe) has yet to be determined, but we can already see some of its major effects on tax laws in the United States.

Just a few months…

Unemployment Claims Spike: So May EDD Audits

Unemployment claims are in the millions as a result of the coronavirus epidemic and the ensuing quarantine and lockdown. Small businesses are being deeply impacted by the downturn and many are having to lay off over half their workforce. Since…

Coronavirus: Business Owners Can File for Unemployment

As the greater impact of coronavirus COVID-19 continues to worsen, it is important to stay up-to-date with the potential repercussions as a business owner. This year’s tax filing deadlines have been extended to July 15th which will offer…

IRS Extends Deadline to Pay [and File as of 3/18] Taxes to July 15, 2020

This article was edited on 3/18 to reflect the update from IRS that businesses now have an extension not only pay but also to file taxes.

IRS Extends deadline to PAY AND FILE taxes to July 15 for most individuals and businesses.

The…

How IRS Criminal Investigations Start

IRS Criminal Investigations, How They Begin and Why

IRS Criminal investigations begin with a suspicion of fraud and violations of:

Internal Revenue Code

Bank Secrecy Act

Money laundering statutes

...Among others.

When IRS determines there…

New Requirements For IRS Form 5472 (for Foreign Shareholders & Corporations)

Perception of the requirements for IRS Form 5472 for foreign businesses are influenced by the globalization of the economy. In the tech world we currently live in, the internet has almost eliminated country boundaries and has allowed foreign…

Precision & Attention to Detail Are The Hallmarks of Milikowsky Tax Law

John's level of precision and attention to detail is unmatched.

At Milikowsky Tax Law, we partner with CPA firms to provide the highest level of service and support to their clients in case of IRS Audit, EDD investigation or other tax controversy…

What to Do if You Are Contacted by IRS Criminal or FBI

If an IRS agent shows up at your door what should you do?

When IRS or FBI conduct a criminal investigation into a company's taxes they often show up unannounced at that company's place of business or, at the home of the company's controlling…